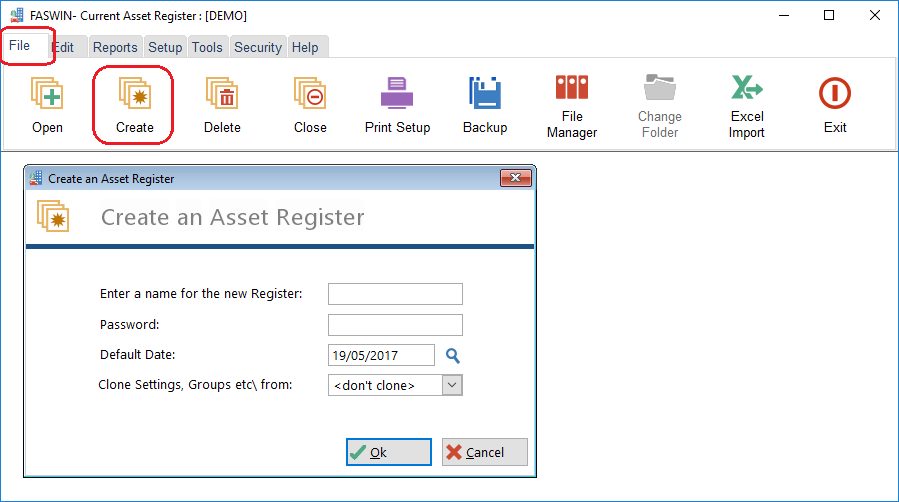

Create one or more asset registers. Faswin allows you to create multiple Assets Registers. Ideal for accountants doing the books for multiple companies, or for companies with multiple divisions.

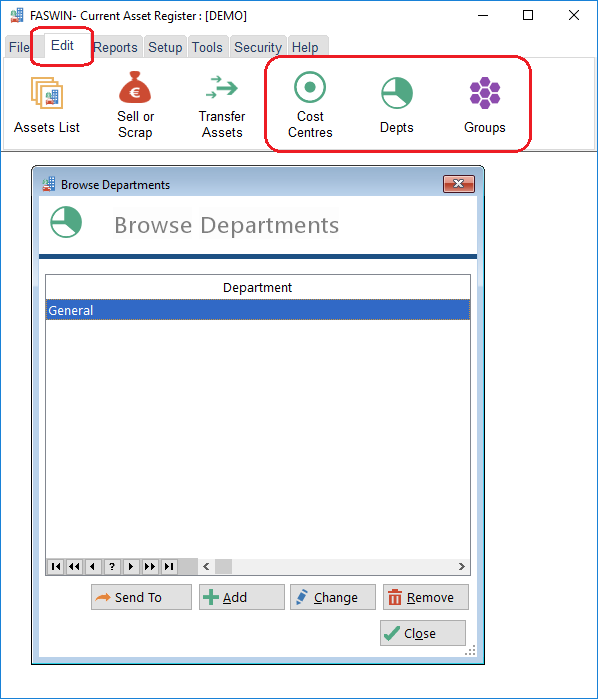

Create Departments, Cost Centres, and Groups. Assets can be grouped together in to these different classifications which is really helpful if you have lots of assets to manage. If necessary you can move assets between different classifications. If you only have a small number of assets then you can skip this step and a General department and Cost Centre will be created for you.

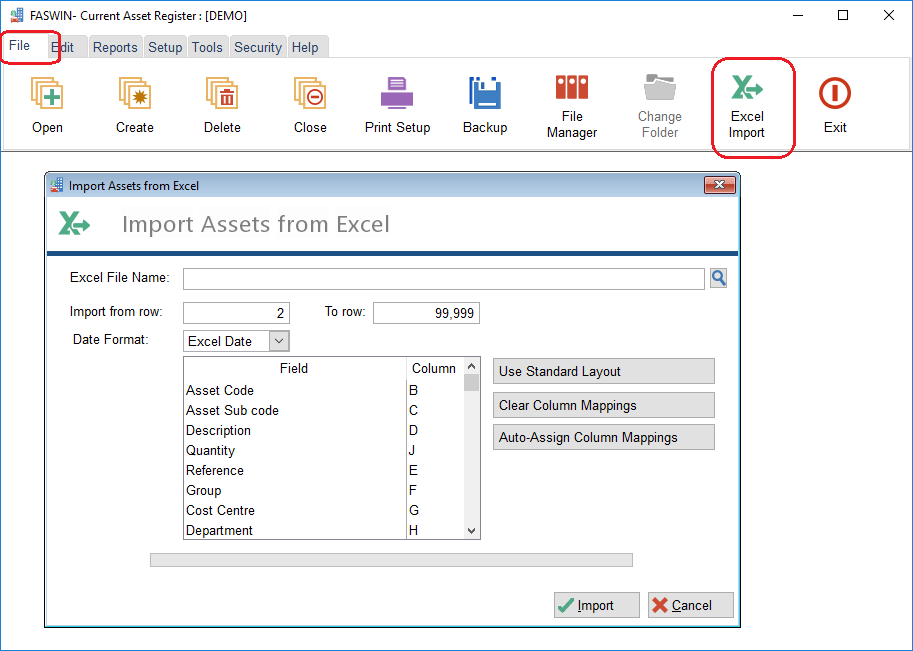

Import your existing asset information from Excel,

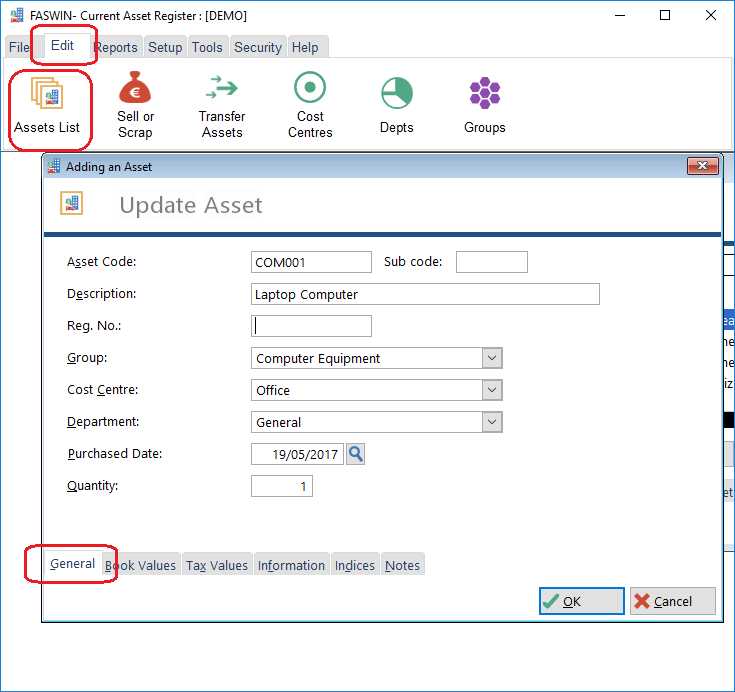

or capture your assets using the simplified on-screen form. Faswin has fields to capture heaps of information about your assets, but most of the fields are optional. So use as many of them, or as few of them as you like.

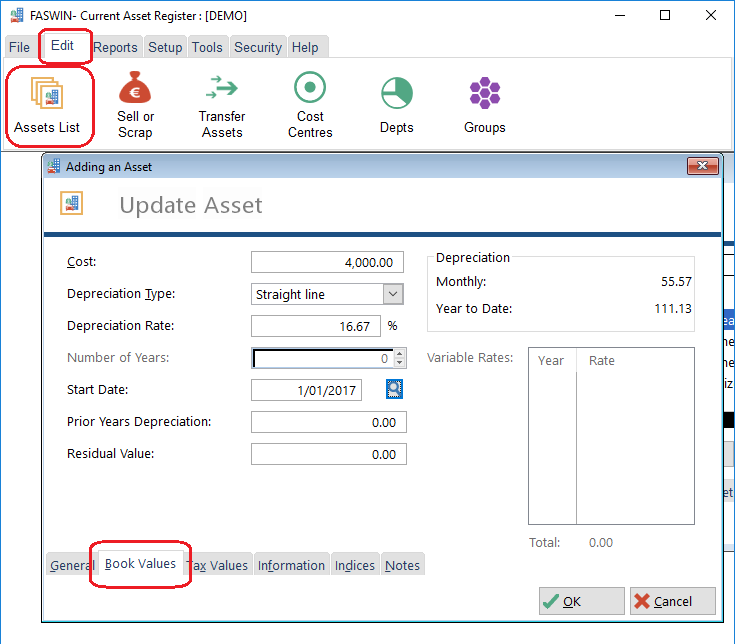

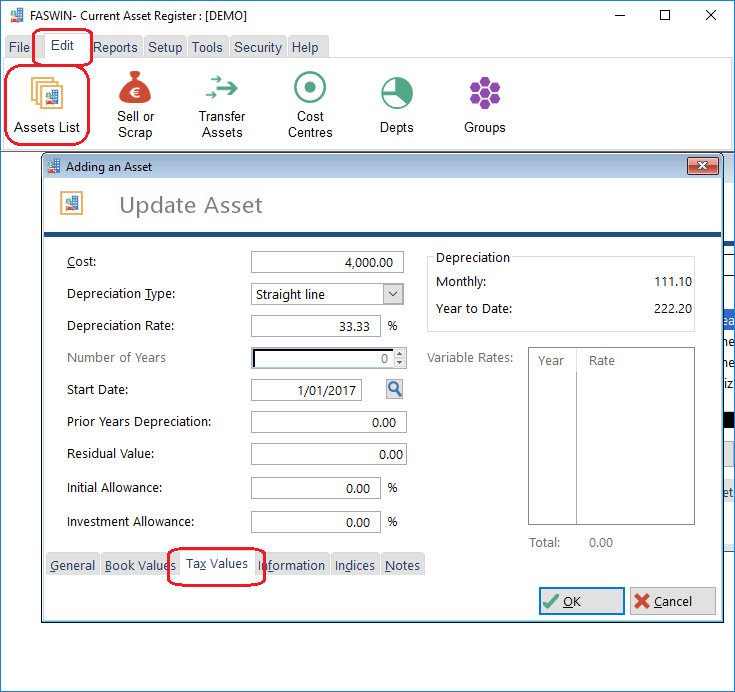

If necessary you can store different settings and values for internal and external records. In other words Faswin is able to calculate your depreciation in two ways simultaneously. On method for internal accounting requirements, and another method for external accounting requirements required by your tax collector.

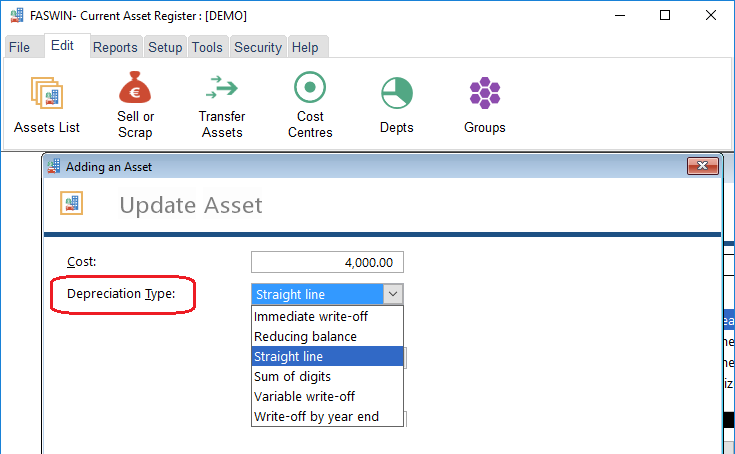

All common depreciation methods are allowed, and you can use different methods for different assets.

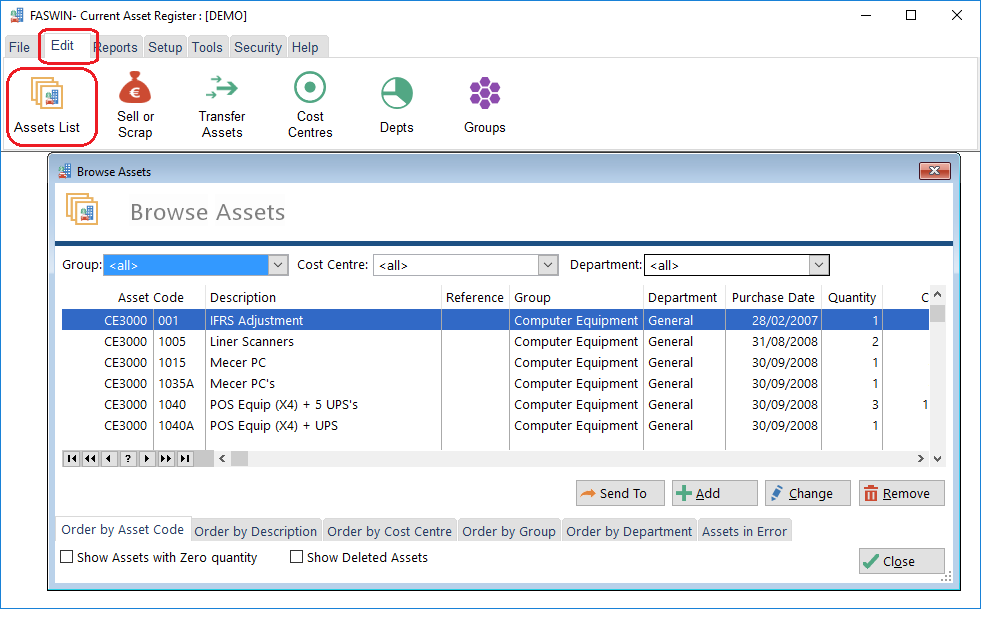

Browse through your asset list using the intuitive list interface. Update asset information as you please. Capture new assets as you purchase them. From this window you can also export your asset information to Excel, print the list as-is or even email the list to another person.

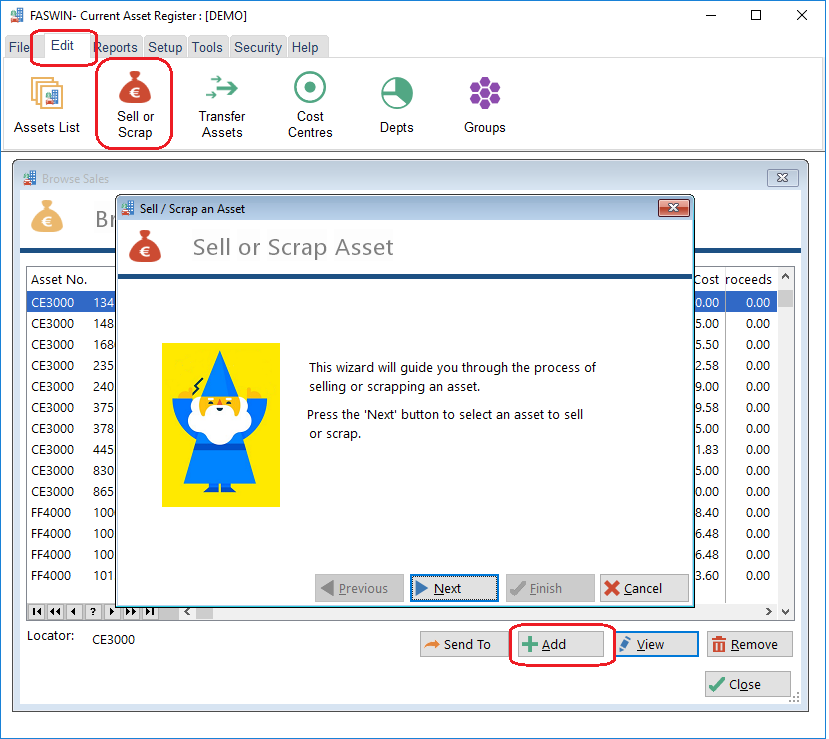

Capture any asset sales, or asset scrapping which happens during the year. Assets can be partially sold or scrapped as necessary. Faswin contains a number of wizards used for uncommon tasks like this.

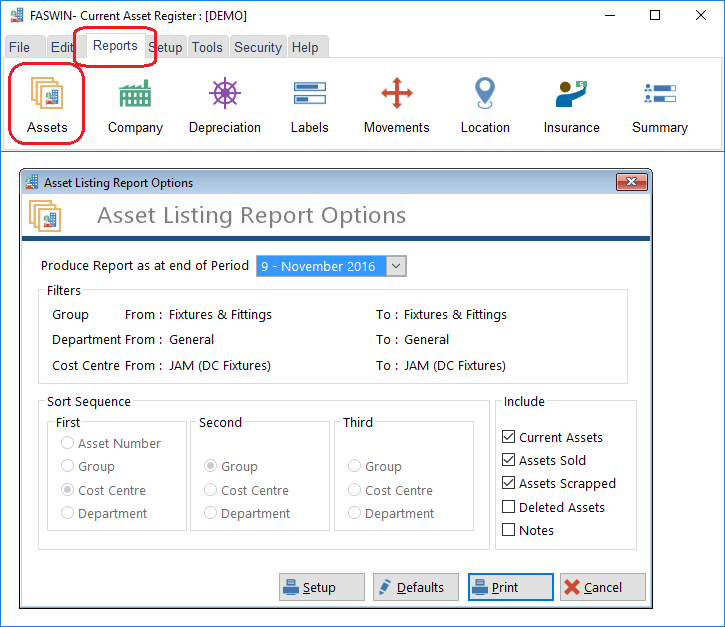

During the year, feel free to report on as many items as you like. There are lots of reports in Faswin to cater for your every need. Reports can be limited to a specific set of assets, or can encompass all the assets. Most reports have additional options as well, for example when printing the asset list you can decide which assets to include in the list.

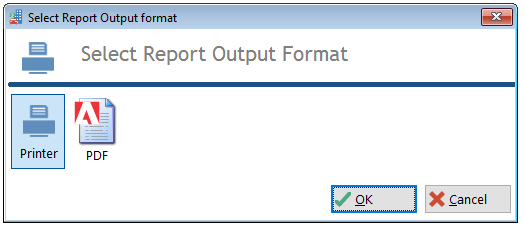

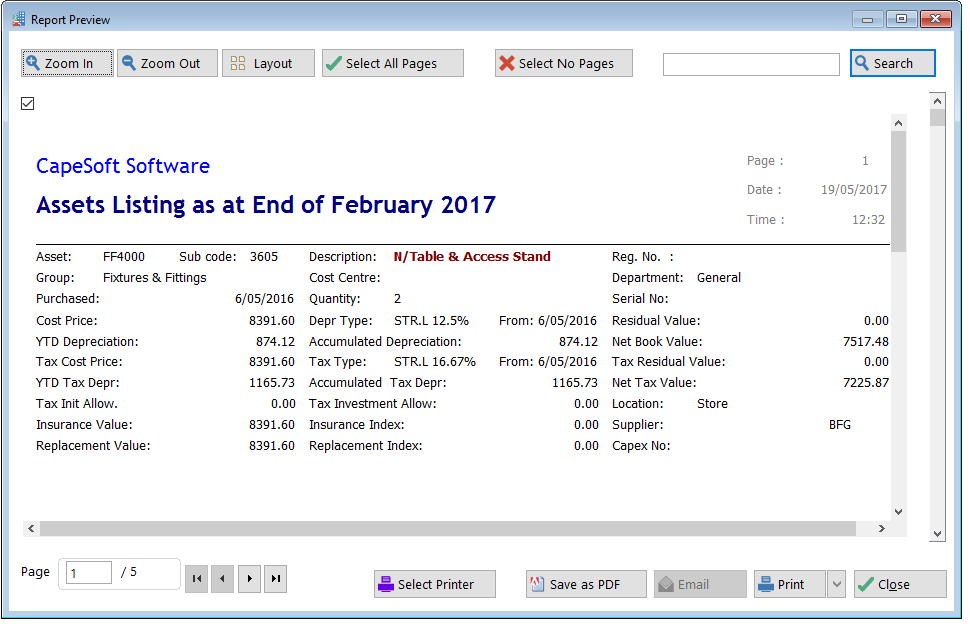

Reports can be viewed on screen using the built-in report previewer, send to PDF files for easy portability, or printed on your printer.

At the end of the year generate all the reports required by your accountant, and your tax man, and do a year end. View multiple pages on the screen at the same time, and optionally select which pages you would like to print.

Capturing all this data is useless if you cannot get the information out of the program, quickly, easily, and in a format which is useful to you.

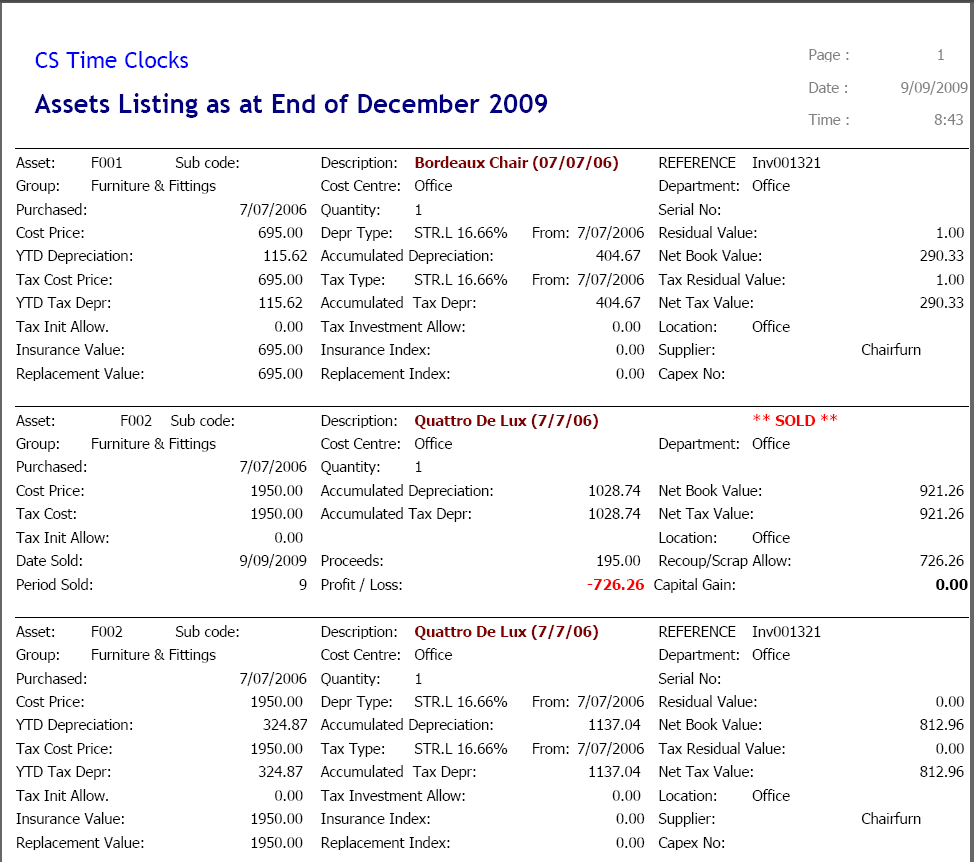

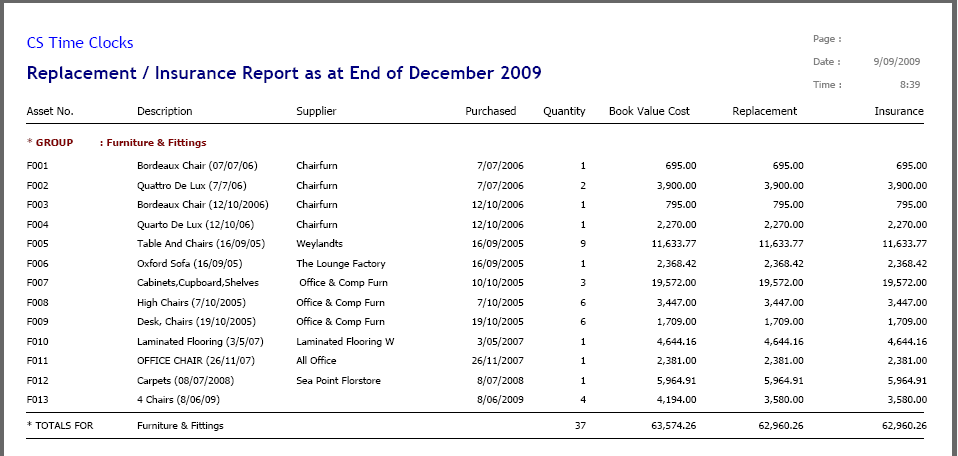

There are 14 major reports in the system, including asset listings, depreciation, movement and summary reports. This is an example of an asset listing report. You can choose to include, or exclude current, sold or scrapped assets.

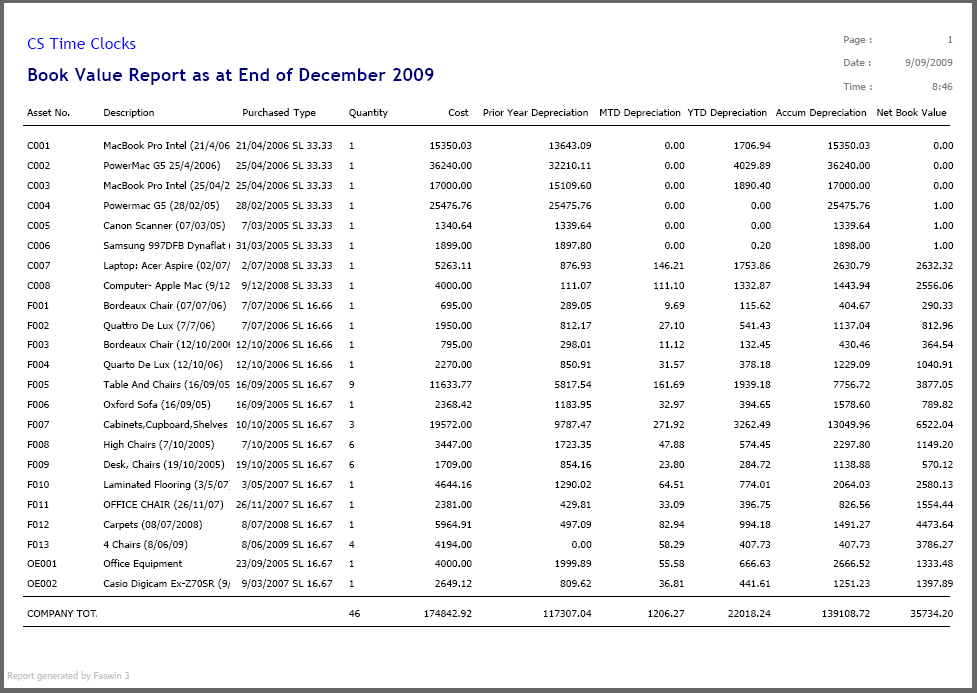

Here is a example of a book value depreciation report. There are numerous other depreciation reports including deferred tax, monthly value and tax value reports.

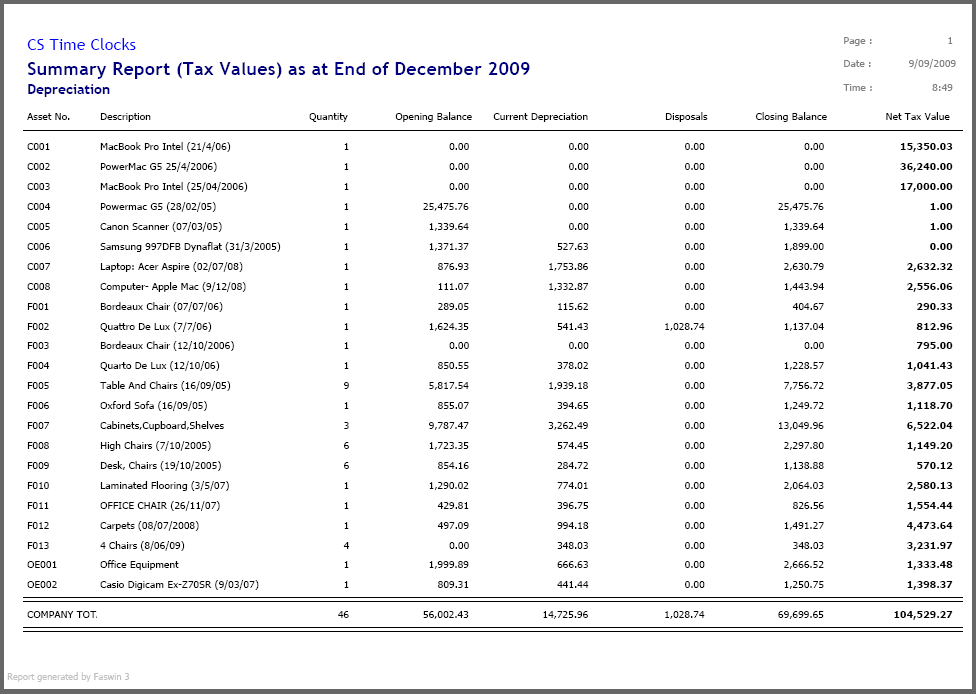

This is an example of a summary report. There are 4 summary reports in the program covering book values and tax values as well as cost and depreciation. This one is a tax value depreciation report.

There are also 5 basic administration reports designed to help you with ancillary tasks surrounding asset management. Like a replacement report for insurance purposes.

That's the basic flow of the data through Faswin, but Faswin is also full of other major and minor features which are designed to make your life easier.

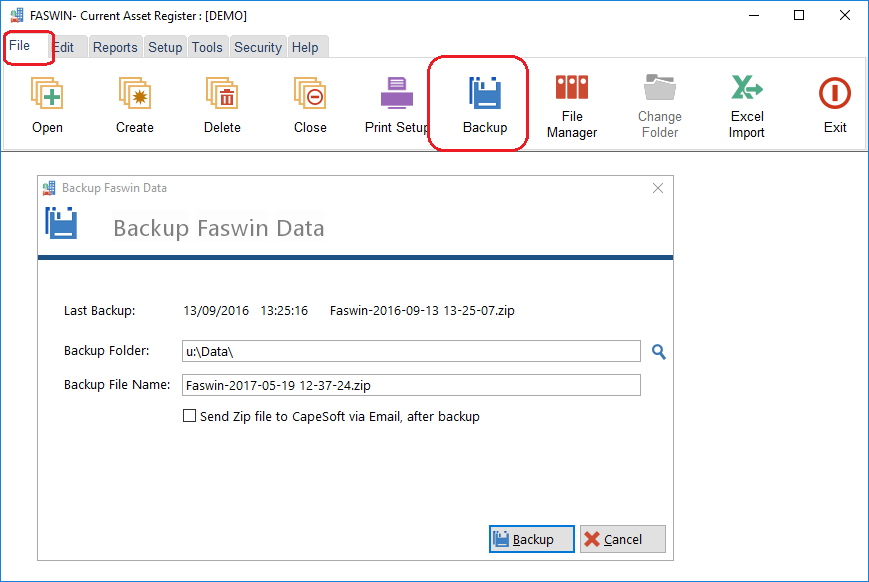

Nothing is more precious than your data, so Faswin includes the ability to backup all the data into a single ZIP file. This file can easily be unzipped to restore data if you make a mistake.

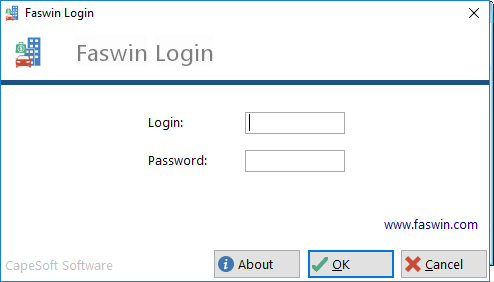

Equally important is controlling the access to your data. Faswin includes the ability for you to require a login to access the program, as well as optionally requiring a password to access an asset register. Yu can add as many users as you like.